EXUS Financial Suite (EFS) has delivered:

35%

reduction in collections cost per account

75%

faster time to deliver new collection strategies

36%

larger portfolio, managed by the same size team, saving $200,000+ annually

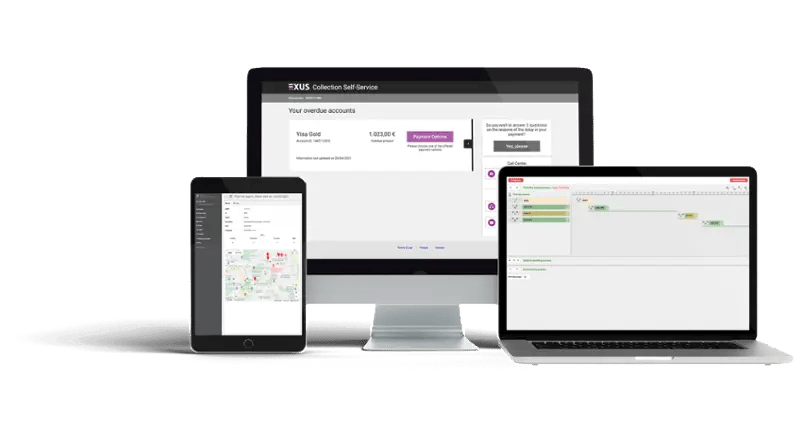

EXUS provides enterprise debt collection software that helps organisations manage credit risk across the entire account lifecycle - from disbursement to write-off or debt sale. With seamless integration in weeks, our powerful solution optimises collections efficiency and improves financial outcomes.

We help organisations:

-

Identify and manage credit risk early with AI-driven insights and predictive analytics

-

Perform efficient, automated collections using flexible, self-managed strategies

-

Manage legal proceedings and recoveries seamlessly through a single, unified platform

- Gain deep portfolio insights with embedded best practices and real-time reporting

- Adapt quickly to regulatory and market changes with a globally proven solution

“The productivity of SCB’s collections team has improved by 10%. EXUS was the cleanest implementation I’ve ever seen"

Colin Dinn | CTO

Country

Why Organisations Choose EXUS Financial Suite (EFS)

Global insight, local impact. Our platform incorporates breakthrough collections approaches from a global network of finance and utilities clients, empowering customers to refine strategies, adapt to change, and consistently deliver better results.

One solution for all collections and recoveries needs. Built with collections teams in mind, our comprehensive platform supports every product type, market segment, and stage and means of collections. With reliable performance, an intuitive user experience, and in-built flexibility, your team is empowered to focus on what matters most: collections, recovery, and delivering results.

Predictable, transparent pricing. With no upfront onboarding fees and clear, consistent costs, our predictable pricing model removes uncertainty and reduces the need for internal budget negotiations.

Benefits of using Exus

Flexible, self-managed debt collection strategies

Single, comprehensive debt collections software platform

Embedded best practices built on 20 years of insights

Global collections expertise

Exceptional customer service

Zero onboarding fees

EXUS updates accreditation for 2026!

.png?width=146&height=146&name=2026%20Arum%20Approved%20Stamp%20(white).png)

XCelent Depth of Customer Service Award

EXUS' Best-in-Class award from

Case Study

First Bank Case Study

How EXUS’ debt collections software empowered First Bank in introducing and managing a new product portfolio

POPULAR ARTICLES

We’re here to help. Arrange a meeting or book a demo with one of our debt collection specialists who can answer your questions and provide expert guidance.