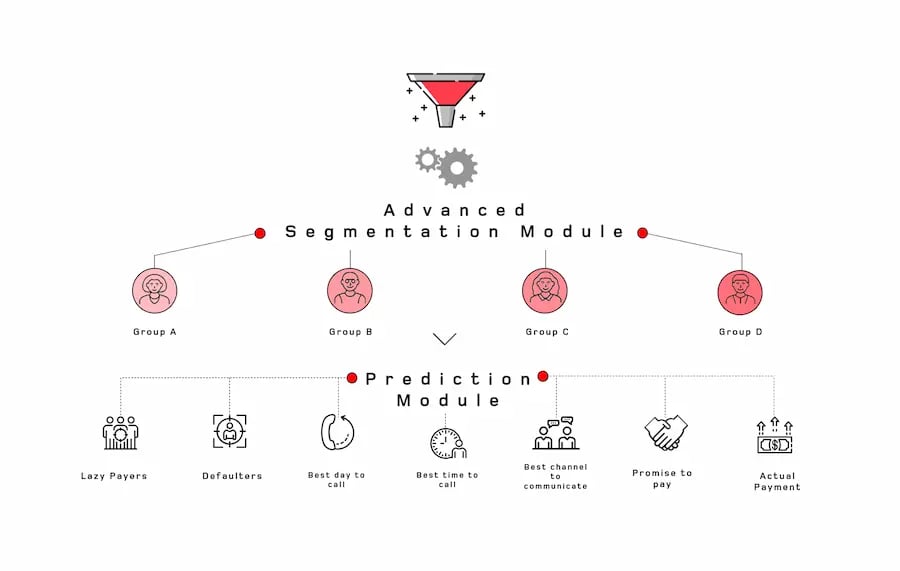

Effective debt collection starts with knowing where to focus your efforts. Our advanced collections analytics empower you to allocate resources strategically, maximising recovery rates. With our powerful segmentation engine, you can dynamically group portfolio segments based on unlimited customer or account characteristics, allowing for tailored treatment strategies. Integrated collections scorecards further enhance decision-making by predicting a debtor’s likelihood to pay. This enables lenders to prioritise outreach, reducing unnecessary contact while ensuring the right customers receive the right level of engagement at the right time.

Data-Driven Strategies for Smarter Debt Collection

EXUS harnesses AI-driven predictive modelling and intelligent segmentation to optimise debt collection strategies. Our advanced analytics help you:

- Identify the best time to contact a customer for maximum response.

- Determine the most effective communication channel (SMS, email, phone call, etc.).

- Predict the likelihood of a customer making a promise to pay-and following through.

- Detect "lazy-payer" behaviours and anticipate repayment patterns.

- Recommend tailored treatment plans using a next-best-action approach.

Beyond prediction, intelligent segmentation groups customers based on behavioural patterns, uncovering trends and enabling data-driven decision-making. By leveraging these insights, organisations can maximise recovery rates while minimising communication costs-ensuring a more efficient, cost-effective, and customer-centric approach to collections.

Schedule a meeting or book a demo with one of our debt collection specialists - we're here to answer your questions and help you find the right solution.