Outstanding debts are a major concern for any organization which leads to bad debt that can have a detrimental impact on their balance sheet and drives to complicated accounting activities.

In this article, we will focus mainly on the high-volume consumer financing within banking and financial institutions. However, the guidelines are equally helpful in collecting your outstanding debt from delinquent or defaulting customers in any businesses.

The most critical question remains as to why a collector is not able to collect on all or most of the outstanding debts. There are several reasons why someone is not able to collect the outstanding debt, this article will shed lights on the most critical, yet important, step if taken in latter and spirit can help collect debts with ease and comfort.

This article will revolve around ways and means to avoid incremental bad debts by adopting few recommendations that will bring quick wins and improvement in your collection’s activities. The important thing to remember is that the debt collections is critically dependent on the quality of approach and treatment. Debt collection is one of the most challenging tasks in the world. However, by adopting some basic rules, one can easily overcome this challenge even the post Coronavirus syndrome where institutions are experiencing the higher volumes of delinquent cases and changing regulatory requirements.

Be Prepared:

First and foremost is to be prepared. If you are collecting from a customer who is overdue on his or her payment (the word delinquent customer will be used throughout this article), you do have the required skills to be a debt collector. If collections activities are being carried out without the required skills, debt collection is not the business that you would like to be doing for fun. It is better to pass on your debt collections to an agency that has the required skills and understanding of the debt collections business.

One of the key observations remain that the debt collectors are not well prepared to make that one call that will pay the outstanding debt. In this line of business, if it takes more than one call to collect, the Collectors needs coaching and training on calling skills, problem resolution skill and negotiation skills to become efficient.

NASCAR great Bobby Unser is credited as saying, “Success is where preparation and opportunity meet.” There cannot be an argument that you can never be over-prepared when it comes to tackling a debt collection call.

For starters, set yourself in the mood for making this phone call. For most people, making that phone is the least of the priority as it tends to get you out of your comfort zone. Another reason why it is so difficult to make this call is the fear of failure or embarrassment. Stay calm and collected. Never take the statement personally, customers have the tendency to through you off with a list of complains, start screaming and try manipulating the situation. Never be thrown off by this behavior.

It is a good idea to have a list of common excuses that have come across at the individual level or a collective level within your collections department. Consolidate those excuses, come up with suitable answers, and store them – this could be organized in a file, on your computer, or even better, make them part of your collections script. The automated collections system does provide a scripting facility while making a call to a delinquent customer.

SMART SCRIPTING:

The mental state of the collector has a strong impact on how you handle the delinquent customer and how they respond to you. You must treat each of your calls as if this was the very first call on a beautiful day. Put a smile on your face. The customer may not see your face but certainly can feel your smile.

If the previous call irritated you and made you upset, take a few minutes to calm yourself down, slowly count from 1 to 10, and start afresh. The customer generally responds to the kind of tone used during the conversation. The positive mood of the collector is considered to be contagious and likely to get a more positive response from the customer.

Never take your speaking voice for granted. The variation of tone used, pitch of the voice, and even the speed at which you talk can have a powerful influence on your listener.

Most collections activities are mandated to have a recording facility as part of the regulatory requirement. Take advantage of that requirement. Listen to your calls frequently. This will give a greater sense to adjust your tone, pitch, and the speed of the conversation with the customer. It may take some extra effort but as the experts say, “Success is strongly linked to preparation”.

The second most important thing in debt collection is to take control of the call and never let it slide. When you are prepared, you will be able to manage the call in such a way that you control the customer’s response. There are some tricks of the trade that must be kept in mind. Always address the customer by name throughout the conversation to show the respect on your part and command their attention. Be careful not to overdo it though, or it will start to sound artificial and bothersome.

Even if you think the customer is making an excuse or objection, make the customer right by asking the specific question as it allows to maintain open lines of communication. The idea behind this approach is to disarm customer defensiveness.

The open-ended questions help get more information. Listening carefully and making notes shows that you care and are serious in resolving the prevailing issues. This tends to provide clues on the seriousness of the customer on making that payment. At the same time, it will provide subsequent ammunition to counter any excuses that may have been used in the past.

Know Your Customer:

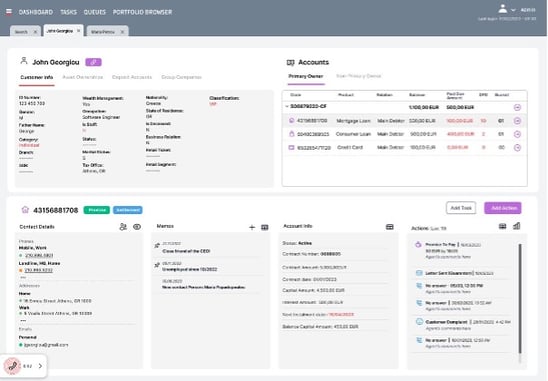

The automated collections systems provide a wide range of information collected from variety of sources within the lending institutions. This may be collected from the core banking system, Data warehouse, Loan Origination/Management System or the CRM.

The list of information a debt collector needs is comprehensive demographic information, financial information, and the past history of this customer.

The demographics provide comprehensive information on the customer based on factors that can include, but are not limited to:

- Full Name

- Place of residence – Full Address

- Place of Business/Work – Full Address

- Contact numbers – Home / Office / Mobile

- Age and generation groups

- Sex, gender, or sexual orientation

- Nationality

- Race

- Educational level

- Occupation

- Household income

- Marital status

- Number of children

- Homeownership (own or rent)

- Health and disability status

- Political affiliation or preference

- Religious affiliation or preference

Most of the information is provided by the Loan application filled at the time of acquiring the loan and is dependent on the information gathered and captured in the system.

The financial information on the other hand is equally critical as it is a decisive factor in ordering your priority in calling the delinquent customers. The financial information comprises the following:

- Days Past Due (DPD) or Bucket

- Outstanding Amount

- Overdue Amount (Past Due Amount)

Past Behavior Information (if any):

- Product Type – Credit Card, Auto Loan, Housing Loan, Business Loan

- Loan Type – Close-Ended (Installment Loans), Open-ended (Running Finance Loans)

- Date of booking

- Loan Amount

- Past Due History (Number of times in delinquencies – 30 DPD, 60 DPD, 90 DPD. etc.)

- Number of Broken Promises

- Number of Kept Promises

- Best time to Call

- Best Number to Call

- Previous Notes

All such information essentially helps profiling the customer and helps set the priority for a call to the customer. Further, this not only help adopt the best possible mode of communication with the customer like, will the customer respond better to an SMS or an Email or a phone call would be a better mode of communication to get the customer to pay whereby the collector need to set the tone for the call.

Through our experience in the collections business we have not come across a category that I will not fit into the following four types of customer. There can be a further division of the type of customer but you can always fit those types into the following four types of customers when it comes down to collecting a debt:

Lazy Payers

Those who forget and need a reminder

Willing but Unable

inancially distressed, sickness or death in the family

Able but Unwilling

Irate Customers, Complainers and just not willing to pay

Credit Criminals

Skips, Fraud. These are customers who acquired loans through fraudulent means and had no intention to pay the loan.

AI Capabilities:

With a full 360-degree view of the customer and a better understanding of the customer as to which category it falls under within the above four categories mentioned, a collector with an appropriate skill set will allow how to deal with each and every customer accordingly. If you lose this opportunity to arrest the situation during the call, you will end up allowing the customer to have an unnecessary extension without a commitment for the payment to be made.

Identify the options

Now that you are well prepared and know your customer, you can evaluate the options that you have to get that commitment from the customer for payment on the overdue amount. This is the ultimate objective and how well this particular objective is achieved, depends on the application of the right fit approach.

It is important to understand the situation and the kind of customer you are up against. Is Persuasion a better option or to negotiate the overdue payment? These are two separate options. Do not confuse persuasion with negotiation. Persuasion is not negotiation. However, there is a greater use of persuasion skill during a negotiation.

Let us understand what persuasion is and how this helps in achieving our objective of debt collection. Persuasion is a process of getting the customer to do what you want them to do – in our case, make them pay the overdue amount. Asking the right question forces the customer to talk and the real art of questioning lies in listening to what is being said. Pick up the keywords and turn information into intelligence. As an example, If the customer says, “I don’t have money to pay”, the simplest question would be to ask, ‘How did you end up in this situation? This will allow the customer to open up.

A sense of responsibility and good values drive many customers to pay their bills on time. Motivation is a powerful and positive tool and gives customers a sense of well-being knowing that they are doing the right thing and fulfilling their commitments.

Identifying and encouraging this behavior is a smart thing to do. Everyone loves a pat on the back.

Negotiations, on the other, is a process of moving towards a compromise. In negotiations, each side gives up ‘something’ to achieve an agreement as compared to persuasion.

If you can successfully persuade someone, you may not give up anything. Put your efforts into persuasion first. It is faster, easier, more comfortable and perhaps most importantly, cheaper than negotiations.

Be open for the settlement

The importance of identifying a high-risk customer is the key to success. It helps you get to these customers on priority. An economic uncertainty left people with managing their liabilities in a manner that has messed up all priorities and commitments. It is although more important to identify early in the stage customers with financial difficulties and low propensity to pay their dues on time.

Look for the warning signs proactively, focus on those signs of potential non-payment, and offer support to the people you believe are at risk. This will allow you to reach those customers on priority before it is too late. Effectively, you are ready for lower-income and the hardship that customers are faced with.

The customer relationship matters, when you are able to identify the nature of the situation, you will have to mold your approach to get better results. This may require you to be ready for certain payment holidays, type of forbearance most suitable for the customer type. Should you have a high volume of such customers with many needing long-term help, it is better to have a comprehensive collections policy in place whereby consistent treatment is permissible.

Automating the collection processes will ease pressure on overstrained collections teams. This will allow you to handle your customer communications better and identify vulnerability of customers more swiftly.

Close the call

Never close the call without reiterating the outcome of the call. Review their commitment, your expectations, and the consequences if your expectations are not met. Emphasize the urgency of the matter. It’s easy for the customer to forget what you’ve agreed upon as soon as the call ends, especially if they don’t think you were really concerned about the outcome.

Remember, the objective here remains that a commitment is in place. If you are not able to get a commitment for a payment in full, get a promise of something — a partial payment or a call back with a payment date. Make sure you control the timing. For example, you should be asking “What time today will the payment be made?” as opposed to “Do you need more time?”

PROMISE TO PAY

Summary

With the challenges come plenty of opportunities. With economic downturn and the post COVID-19 crisis escalating consumer desire for digital channels, automation is key to customer experience as well as easing pressure on collections teams as cases grow.

With the focus on debt collection moving further in the direction of preventing financial hardship and providing bespoke support to customers, the sector could find itself leading the way for customer experience and help brands to build social value.

The steps mentioned above can improve the effectiveness of your collection calls, however, there are no magic tricks as every customer is its own persona. One single step may work really well with one at the same time may not yield the same result with another. Listening carefully to the customer and picking up clues for the best way to handle each situation is the to success.

And finally, if the customer doesn’t follow through on their commitment, make sure you follow through on the consequences. If you don’t, they will never take you seriously.

Put a stronger stress on the importance of the commitment. One way to do this is to ask the customer for an advice as soon as the as the payment is made on the promise date. This will prompt you to follow up. If the customer failed to call, the chances are that the payment is made on the promise date.