Exus Blog Article

Middle East Banks Are Set Up For Failure (But They Don’t Have To Be)

Global changes in banking are having profound effects throughout the industry. Retail banking experts gathered at the most recent Middle East Retail Banking Summit to discuss these changes. The top three trends they identified were:

- The need to generate more revenue from existing business, in order to fuel sustainable expansion.

- A necessity to rethink distribution models as brick-and-mortar locations give way to digital and mobile channels.

- A critical focus on customer service as a competitive advantage spurred by changing customer demands.

Banks in the Middle East are aware of—and proactively trying to address—these critical trends. But there’s one thing they aren’t doing that could spell failure, no matter how much they grow.

They have failed to modernize their collections and recovery operations. Collections and recovery have changed dramatically, and Middle East banks must keep up or lose out on key revenue-generating and customer retention opportunities.

In the past, these banks have performed collections activities (even complex ones) using only a single channel, and with little or no technology to deliver insight into customer behavior and risk. This is a critical oversight, but it can be addressed.

Here’s how.

1. Centralize Collections Operations

Whatever current collections operations and activities your bank undertakes, they must be centralized under one authority. This ensures consistent policy, action, and accountability throughout every stage of the collections and recovery process.

The best banks don’t just create a central authority, either. They physically centralize collections centers to make the industrialization of collections easier. With centralization in place, banks can better control collection costs and ensure profitability as they scale.

2. Implement Smart Risk Scoring and Segmentation

The next step is to implement smart risk scoring models to make sure portfolio liabilities are properly managed. The best models use combinations of behavior and quantitative criteria to assess risk in real-time. They also employ scorecards that track performance over time to inform long-term strategies.

Once effective risk scoring exists, portfolio segmentation is essential. You may use basic metrics like product type, account balance, or months on a book to segment accounts for attention by collections teams. Or, more complex metrics—like past customer or account behavior—may be employed.

3. Reach Customers Across Multiple Channels

The modern customer uses more channels than ever to a bank and communicates with an increasing emphasis on social media and mobile. Customers in the Middle East are at the forefront of this trend. Smartphone penetration rose in Middle Eastern countries (with the exception of Egypt) by at least 11 percentage points between 2012 and 2013 alone, eMarketer reports.

That has serious implications for Middle East banks. Increasingly, the amount a bank recovers is directly dependent on the number of customers it manages to contact. A simple call no longer suffices, and it’s easy to miss out on a possible settlement when you use just one channel.

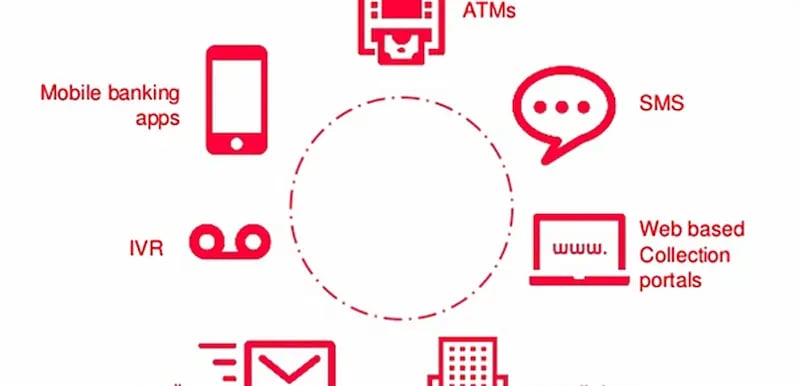

Collections operations at Middle East banks must embrace alternative channels, including web portals, voice response units, text messages, and mobile transactions.

4. Adopt Specialized Collections Software

Adopting specialized collections software is the major differentiator between banks that succeed in this new landscape, and those that don’t. Specialized software is a centralized system that improves every stage of the collections and recovery process.

The best systems have intuitive visual interfaces that can be used by anyone within the organization, and include the following features:

An early warning system to flag portfolios in danger of delinquency.

Collections management functionality to streamline operations.

Robust analytics provides insights into customer behavior and risks.

Self-service capabilities, so that customers can self-cure their balances.

Legal recovery features simplify the entire litigation process.

By following these four steps, Middle East banks can beat the competition and ensure they stay ahead of the top trends in retail banking. The result is improved revenue generation, better customer relationships, and, most importantly, peace of mind.

How Do You Start Transforming Your Collections Operations?

By downloading The Collections and Recovery Best Practices Guide. This free resource will help you streamline, improve and optimize every aspect of your collections operations with best practices from experts with 25 years of industry experience.