Damaged reputation and balance sheets post-financial crisis have led to external scrutiny by the government and the general public. In addition to public mistrust, one of the lingering effects of the Eurozone crisis was the drafting of Basel III regulations.

Understanding the intent and implications of Basel III will help banking institutions comply with requirements, and develop new business strategies under these stricter regulations.

Background on Basel III

The Global Financial Crisis of 2007-2008 and the subsequent Great Recession in 2008-2009 revealed deficiencies in financial regulation, particularly around liquidity. This led to the creation of Basel III, or the Third Basel Accord, new regulatory standards on bank capital adequacy, resilience, and market liquidity risk.

The first version of Basel III was agreed upon by the Basel Committee on Banking Supervision (BCBS) in 2008. However, changes from 1 April 2013 extended implementation until 31 March 2018, giving banks several years to fulfill the requirements.

The goal of the reform measures is to minimize stresses to the financial system while improving governance and transparency. Specifically, Basel III increases bank liquidity and decreases bank leverage through capital and liquidity regulations.

- Capital requirements regulate capital, risk coverage and leverage; risk management and supervisory review process; and market discipline.

- Liquidity requirements set a global liquidity standard and supervisory monitoring.

- Because of the larger risk, they pose to the entire financial system, global systemically important financial institutions (SIFIs) must have a higher loss absorbency capacity, in addition to compliance with the Basel III regulations imposed on all banks.

Below are three key takeaways for retail banks learning to operate under Basel III requirements.

1. Basel III Aims to Reform at the Individual Bank Level

Like Basel I and II, the Third Accord continues to develop the global banking regulatory framework. Basel III focuses on bank deposits and other borrowing rather than loss reserves for loans, as Basel I and II did.

Basel III introduced a minimum "leverage ratio" based on the bank's Tier 1 capital and its average total consolidated assets. This prevents banks from overextending themselves or taking bad risks and helps them have sufficient funds to cover losses in the event of a financial meltdown or bank run.

By putting safeguards in place at the individual bank level, institutions are more resilient to market shocks and less likely to put the entire system in jeopardy.

2. Basel III Increases the Cost of Lending—and Borrowing

Higher capital requirements under Basel III subsequently raise bank funding costs. As a result, many institutions must pass along these expenses to their customers. Meanwhile, an ongoing rise in Europe’s non-performing loans reduces available capital, further limiting lending potential.

These new realities have left many European retail banks between a rock and a hard place—seeking to reclaim lost revenue with fewer options at their disposal.

3. Basel III Requires a Shift in Banking Business Strategy

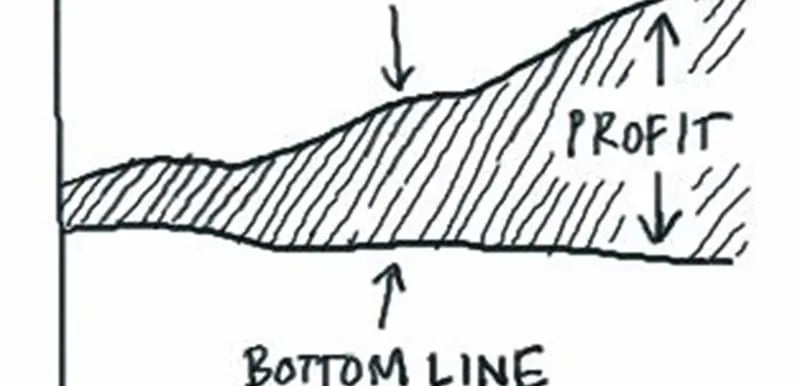

Reduced credit availability, rising levels of consumer debt and an increasing number of non-performing loans to be managed have heightened the need for efficient debt collections and recovery. Furthermore, siloed data makes it more difficult to assess the loans on banks’ books. Without clear insight, regulators require banks to keep more capital on hand, inhibiting loan capacity and threatening profitability.

Some retail banks have shifted their business strategy to collections and recovery optimization. The goal is to streamline processes, improve internal efficiencies and tap into this underutilized revenue source.

Today’s flexible, responsive operational and IT systems provide corporations with the agility and insight into the full collections process—from pre-collection and early collection to legal proceedings and write-offs.