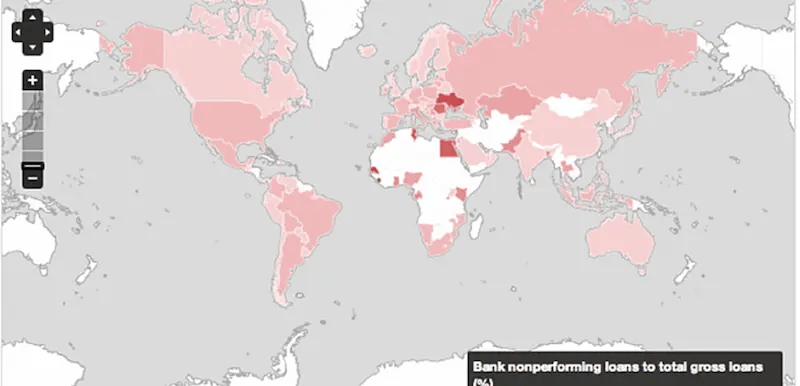

As non-performing loans rise and new regulatory measures constrain credit availability, collections and recovery is an increasingly important revenue assurance and generation channel. While non-performing loans are an issue worldwide, Central / Eastern Europe and North Africa have the greatest need to capture more revenue from these loans.

The above chart from The World Bank shows areas of greatest loss between the years 2009-2013. Central / Eastern Europe and North Africa show the highest volumes of non-performing loans during this time frame, specifically in the Ukraine, Tunisia, and Egypt.

Collections and recovery teams must redefine their purpose and processes to increase profit margins and keep their organizations competitive in this changing landscape.

How? By reassessing collections practices and adopting new tools that improve collections success rates.

Rethink Collections and Recovery

Your organization needs to rethink how collections processes are structured. Start with the appointment of a single authority for your collections that can manage the process from beginning to end. A 2010 McKinsey & Company study found that centralization leads to success in organizational transformation:

“Companies that undertake transformational change have to succeed at the basics, such as creating clear, stretching targets and defining a clear structure.”

This improves processes across collections and recovery departments, making them easier to understand and implement. It also reduces confusion, leading to greater control and efficiencies.

Adopt New Processes

Insight into every stage of the collections process is key to this sort of organizational change. That comes through adopting stringent processes. Doing so will readily show strengths and weaknesses in the system—like obvious gaps or actions that allow for quick fixes or adjustments.

Today’s banks are under pressure to mitigate risk while providing greater transparency into account performance, improving efficiencies, and meeting regulatory compliance requirements. Take the opportunity to discover how processes are truly performing against all organizational needs, and make necessary improvements to evolve:

- Implement debt collections technology where possible to gain greater insights, streamline each stage of the recovery process, and manage loans more efficiently.

- Expand into multiple contact channels to reach customers and clients where and how they prefer.

- Have a central point person to coordinate efforts across channels.

Build Targeted Collections Strategies

Business analytics and socially enabled business processes are the top two business technology strategies for 2014, according to audit and assurance company PricewaterhouseCoopers. Retail banking organizations should take note of the need for collaborative business processes driven by enhanced insight, and build their collections processes accordingly:

- Identify key audience demographics, pain points, and hurdles to collections.

- Leverage analytics for insights into consumer behavior that may help your business identify revenue-capturing opportunities.

- Utilize an account-level collections approach for increased efficiency, paired with a customer-level approach that fosters relationship building and loyalty.

Use Effective Collections Scoring and Segmentation Techniques

Each demographic segment of your customer base will have individual needs, characteristics, and risk levels. Effective scoring and segmentation of a customer base lead to even greater collections efficiency.

Assess and score effectively with a technology solution that provides robust scoring capabilities. Select specific segmentation strategies that strategically maximize the number of self-cure accounts. This allows your organization to acquire more returns without the need for more work or new business:

- Adhere to standard strategic segmentation models.

- Avoid unnecessary cost acquisition and customer irritation.

- Identify escalation risk to avoid more non-performing accounts.

- Create consistent, yet flexible, processes that help you avoid misunderstanding, increase repayment likelihood, preserve the customer relationship, and understand process inefficiencies.

How could your business re-evaluate and improve upon existing collections processes? Let us know your thoughts on evolving systems in the comment section below.

Meet New Needs with Evolved Processes

Learn more about improving your collections and recovery operations as your business redefines its processes. Download our free guides