Exus Blog Article

5 reasons customers hate debt collections (and what you can learn from them)

Try as we might change customer opinion, debt collections has struggled to shake its bad reputation in both established and emerging markets. Regionally, this could be down to a multitude of factors; from cultural differences and complicated local court systems to overly aggressive collections practices. These local debt collection problems have a knock-on effect on a regional scale. There are also various shared problems faced by debt collection agencies and banks across the globe.

It would seem that there is a perpetual cloud hanging over the banks that are offering a necessary service but are hamstrung by negative customer sentiment. This leads to a vicious cycle, with poor customer performance reinforcing poor tactics and vice versa. The only way we're going to shift perceptions on a wider scale and affect real change in the sector is to learn from past mistakes and end the cycle at the source.

By shining a light on five of the most common bad debt collection practices, hopefully, we can understand the right way to do things and, in the process, perhaps earn some invaluable customer trust.

Reason 1: Overbiffing

The latest debt collections outrage that has been causing widespread (and righteous) consumer outrage; “overbiffing” refers to the practice of overstating a debtor's balance, leading to debtors paying back more than they actually owe. The term stems from the “balance in full” (shortened to BIF) that collectors inflate. They then use aggressive (and sometimes illegal) tactics to collect on these completely fraudulent bills. One recent example centers on a number of New York-based companies (all controlled by the same rogue dealer known as Robert “Bobby Rich” Heidenreich) that actively encouraged their collectors to engage in the practice. Thousands of debtors were allegedly duped out of hundreds and thousands of dollars.

This is a heinous practice that needs to end sooner rather than later, but what's the solution here? Particularly when it's only a few very bad apples spoiling the bunch. For one, banks need to make sure they retain complete control of the suppliers they use. They may be using third-party collectors, but any issues immediately bounce back on the bank. Know who you're working with, and if you have even a shadow of a doubt regarding their intentions, look elsewhere.

Offering complete transparency at all stages of the debt collection process is another way to tackle the problem. This can be done by increasing customer self-service capabilities, offering your customers access to apps and software that allow them to keep track of their debts at all times, and maintain an accurate record they can reference in any given situation. Ultimately, however, it's a modern problem that really shouldn't have existed in the first place and is indicative of the kind of murky depths some in the sector will unfortunately still lower themselves to.

Reason 2: Field Agents Using Strong-Arm Tactics

Generally speaking, debtors are financially vulnerable people in an emotional state who are often more susceptible to threats and intimidation - something that the worst debt collectors have been taking advantage of for decades. Whilst strong-arm debt collections tactics might seem like an antiquated notion, the unfortunate reality is that many field agents still choose to utilize overly aggressive collections practices. They are a major reason why many consumers still don't trust the banks that offer these services.

Strong-arm tactics often associated with field agents can include:-

● Using intentionally threatening, offensive or coercive language, including profanities.

● Calling debtors at their places of work or during unsociable hours, or even calling their family members and friends without consent.

● Giving false information, including the actual balance due (see “Overbiffing” above).

● Using physical intimidation tactics that can even become violent in certain circumstances.

These tactics simply have no place in the world of modern debt collections and they are often ineffective. Citizens Advice and StepChange in the UK found that over 850,000 people had been victims of forced home entries and many more had been threatened by field agents using practices that could be deemed illegal. In the US, meanwhile, one debt collections agency based in Michigan is being sued over aggressive and intimidating tactics. These are tactics that rarely work, so why are they still being used?

Self-service solutions have proven remarkably effective in combating the need for field agents to step in, but in situations where field agents are required, there are tools that can be used to ensure best practices and more efficient collections. Field collections apps can be used to track the performance of each agent and makes the process so simple and effective that outdated and unwelcome strong-arm tactics should no longer be required.

Reason 3: Poor Customer Service

The customer experience is everything; people are more likely to pay their debt if you treat them like human beings. However, debt collection agencies have developed a reputation for being impossible to get hold of when you need them, but always quick to call when they want you to pay up. What is required is a change in mindset. Whilst it can be tempting for collectors to only get in touch when they need something, by improving their customer service and making themselves more approachable, it's far less likely that debtors will fall into delinquency.

Customer-centric service should be a cornerstone of the debt collections sector and can be achieved in a number of ways. Communication is obviously key here. AI chatbots and live chat options have made it easier than ever before for customers to get directly in touch with the bank, without jumping through the hoops often associated with call centers. When a call center option is necessary, make sure customers are not left on hold for too long and that the caller is patient and understanding with them. A study by Nesta found that 90% of consumers had been kept waiting on hold for too long and 91% found that their problems were not solved after one call. By only putting customers forward to a call center when all other avenues have been explored and focusing call center services on the customers who need it, overall efficiency will improve substantially.

Self-service debt collections software and apps also offer a more modern and flexible route to customer satisfaction. This software not only gives the customer agency by allowing them to track and sort their debts in one manageable location that can be accessed 24/7 on their mobile devices or desktops but also offers alternative debt settlement options that can help debtors scale their debts. This, in turn, will lead to more consistent payments. Organizations using the EXUS Collections Self Service software, for example, achieved a 110% increase in the ratio of kept promises-to-pay, when compared to the bank’s traditional call center operation.

Reason 4: No Flexibility

It might be tempting for banks to ask themselves why they are being painted as the 'bad guys' when the debtors are surely in the wrong for not paying? However, this mindset can lead to predatory practices that could have a damaging effect on the perception of the whole sector. The real solution is to be more flexible with your approach to customers. Give them options, listen to their ideas and their requests, and don't waste your time and theirs trying to squeeze blood from a stone. If a debtor is currently unemployed and struggling to feed themselves, for example, no matter how many times you call them, if there's no money then you won't get paid.

Ultimately, debts need to be repaid, but debtors also need to be allowed to live their lives without a shadow hanging over them. Debtors are far less likely to pay up if they are being harassed.

Flexibility in debt collections can mean anything from offering special assistance during stressful times, to allow customers to create their own payment plans. Flexible communication will also always lead to a more effective dialogue between collector and debtor, which should lead to eventual payment and customer retention. Basing debt collections models on a debtor's actual ability to pay using better analytics, communication, and, of course, flexibility, will allow banks to focus their efforts where they will have a greater impact.

Reason 5: Bad Tech (or no-tech)

“Digital transformation” is a phrase that currently holds a lot of weight in the banking sector. However, debt collections is still playing catch-up. Whilst most banks now offer intuitive apps to streamline the user experience and bring the sector in line with what consumers expect (particularly in an age where 77% of US adults own a smartphone), debt collections processes are, in many cases, stuck in the past.

The notoriously laborious nature of debt collection processes is another major reason why customers hate them. But by investing in the right tech, banks could simplify these processes and make debt collections seem less intimidating as a result. Specialized software systems allow banks to manage accounts from one, holistic platform that works across mobile and desktop devices.

At the consumer end, meanwhile, greater investment in AI chat solutions and app-based collections platforms will create an environment where customers know they have 24/7 control over their accounts. Messaging is now far more common than voice chat and is more regularly responded to, with Forbes finding that 95% of texts are read within three minutes.

Offering customers the chance to do the talking with their fingers might make them feel more at ease with the service. Debt collection is often not a pleasant experience for the customer, so surely it behoves banks and agencies to make the user experience as painless as possible? Digital transformation can go a long way toward mitigating the process.

Conclusion

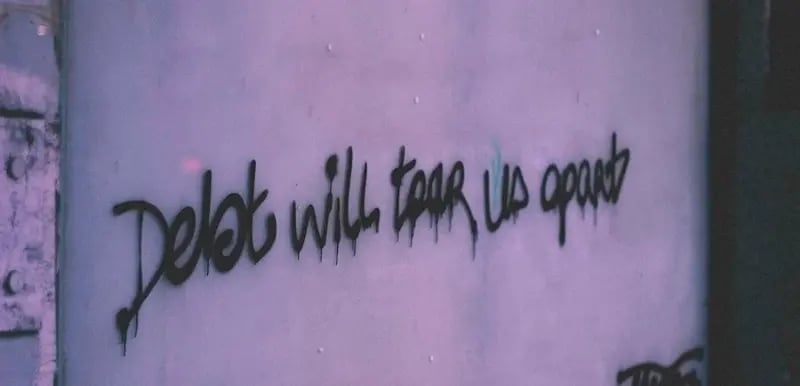

Bad reputations can be hard to shake, but by learning from the mistakes of the past, banks should be able to push forward and apply better practices to every stage of the collections process. Ultimately, it should be all about fostering honesty and trust between collector and debtor. Without trust, everything falls apart and this trust goes both ways as customers need to trust banks to take care of their savings, whilst banks need to be able to trust customers to repay when they borrow.

In order to create this bond of trust and shake their reputation as bullies, banks and collectors need to start practicing empathy towards their customers. If this greater sense of understanding is coupled with practices that allow customers the flexibility to pay what they can, when they can, and they are given the tools that will allow them to do this, there's every chance that the hate many customers feel towards debt collections could blossom into something a little more positive.